F4FI understands the need for unbiased financial education is at an all time high.

%

of Americans have less than $5,000 in savings.

%

of all employers offer a 401(k) according to the Census Bureau.

%

of Americans aged 40-49 have taken money out of a retirement plan and paid penalties for early withdrawal according to a recent popular financial institution's survey.

Take advantage of F4FI workshops.

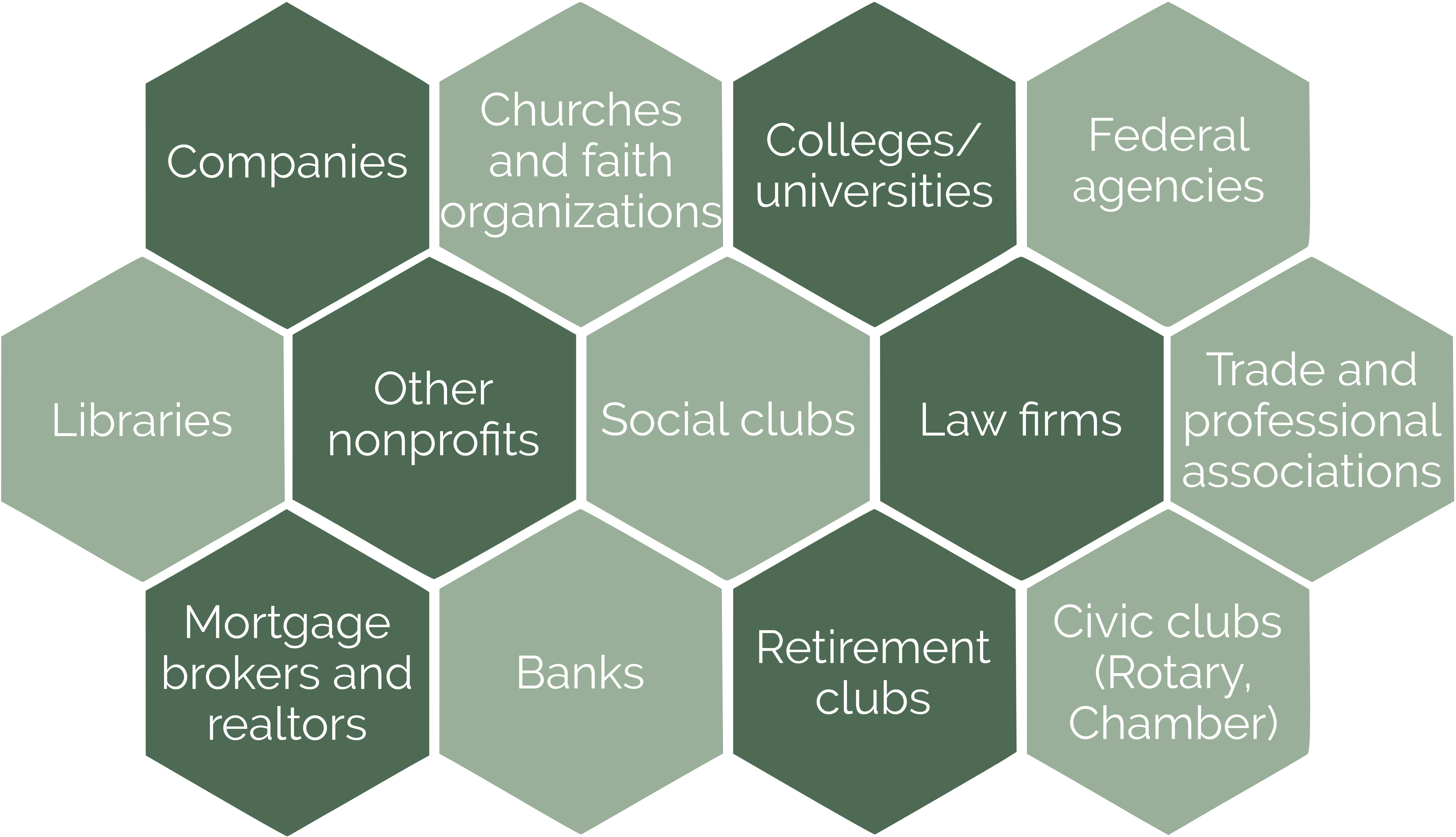

F4FI partners with a wide variety of organizations across the U.S. who have a desire to help their members/employees obtain a higher standard of living through professional free financial education. The opportunity to provide financial wellness education is something F4FI takes very seriously.

Popular workshop topics

Our most popular workshop topics are listed below. There is no limit on the amount you choose to offer. Educational workshops can be held in person or virtually.

Class participants are encouraged to ask questions. They may also schedule a follow-up complementary consultation with the educator upon request. F4FI has found this added attention to personal detail helps ensure participants are able to utilize what they have learned in their own life circumstances.

F4FI is always working on new and innovative topics for workshops. Check back often to see what’s new!

Social Security Intro

- How does SS work?

- How are benefits calculated?

- Benefit optimization strategies

- Cost-of-living increase considerations

Social Security Plus - A deeper look into your SS plan

- When do I start my benefit?

- What are my options for taking SS?

- What are delayed retirement credits? Will I get more money?

- How do IRAs and Social Security work together?

Retirement Basics

- Taxes and inflation effects on retirement

- RMDs and IRAs

- Anticipating long-term care needs

- How to avoid outliving your money

Long-Term Care (LTC) Coverage

- What is LTC coverage?

- When do I need to get LTC coverage?

- Low or no-cost coverage

- LTC and Medicare/Medicaid benefits

Taxation 360°

- Today’s taxes

- Tax terminology

- Tax avoidance strategies

- Tax-free savings

Changing Times and Finances - What you need to know

- What should we anticipate and how do we adjust?

- Retirement options

- Benefit and TSP planning

- Career exit strategies

Financial Strategies

- The three stages of your financial life

- The importance of tax strategies

- Planning for retirement

- Life’s curveballs – college debt, taxes, disability, inflation, death

Get "Fiscally" Fit

- Cash-flow management

- Overcoming obstacles to wealth

- Tax and estate planning

- Maximizing your savings and investments

Additional workshop topics include but will not be limited to

- Charitable Giving

- College Planning

- Debt Elimination

- Inflaction – What is it and how will it affect me?

- Legacy Planning

- Rollovers and Consolidation

- Strategies for Business Owners

Testimonials

“Phenomenal! I learned so much and got answers to questions I didn’t even know I had.”

– Colorado

“I didn’t know there are so many options to getting Social Security. I just wasn’t aware.”

– Texas

“My question is why don’t they teach you this stuff in school? This is stuff we need to know!”

– Arizona

“We’re going to start planning for retirement rigiht now. thanks for opening our eyes.”

– California

“The speaker and content get 5 stars.”

– Michigan

“Great job on explaining the different Social Security strategies. Start, stop, start was new to me.”

– Wisconsin

“Tax workshop was great.”

– Nebraska